Community Reinvestment Act Overview

The Community Reinvestment Act (“CRA”) was enacted in 1977. Its purpose was to encourage banks to help meet the credit needs of their local communities. The Federal Deposit Insurance Corporation issued regulations in 1978 to provide guidance to national banks as to how they could satisfy their continuing and affirmative obligations to help meet the credit needs of their local communities, including low- and moderate- income housing neighborhoods, in concert with the safe and sound operations of those banks. Further assistance on compliance with CRA has been provided to banks in the form of joint interagency policy statements issued by the Federal Financial Institutions Enforcement Committee outlining assessment factors by which a bank’s CRA performance will be measured.

Bank of Holland’s mission is to provide financial services to our community and to promote economic growth and stability within the community. It is our policy to comply with all the applicable consumer protection and fair lending laws. No individual will be denied those services on the basis of race, color, religion, national origin, sex (sexual orientation, gender identity or expression, actual or perceived nonconformity with traditional sex- or gender-based stereotypes, and applicant’s social or other associations), marital status, military status, age, handicap, familial status, receipt of public assistance, or the exercise, in good faith, of the rights under the Consumer Credit Protection Act. We recognize our responsibility to our community. We are a community bank, and we must contribute resources and leadership to help our community thrive.

Community Reinvestment Act (CRA) rules and regulations of 2024 require that the Bank of Holland make available a Public File composed of the content available below. All content is made current as of April 1st of each year. Please contact us at (716) 537-2264 should you have any questions regarding the information provided.

Community Reinvestment Act Notice

MAIN OFFICE (HOLLAND)

Under the Federal Community Reinvestment Act (CRA), the Federal Deposit Insurance Corporation (FDIC) evaluates our record of helping to meet the credit needs of this community consistent with safe and sound operations. The FDIC also takes this record into account when deciding on certain applications submitted by us.

Your involvement is encouraged.

You are entitled to certain information about our operations and our performance under the CRA, including, for example, information about our branches, such as their location and services provided at them; the public section of our most recent CRA Performance Evaluation, prepared by the FDIC; and comments received from the public relating to our performance in helping to meet community credit needs, as well as our responses to those comments. You may review this information today.

At least 30 days from the beginning of each quarter, the FDIC publishes a nationwide list of the banks that are scheduled for CRA examination by the FDIC in that quarter. This list is available from the:

Regional Manager

Division of Compliance and Consumer Affairs

Federal Deposit Insurance Corporation

350 Fifth Avenue

Suite 1200

New York, New York 10118

You may send written comments about our performance in helping to meet community credit needs to:

Donald J. Musielak

Community Reinvestment Act Officer

Bank of Holland

12 S. Main Street

Holland, New York 14080

and the FDIC Regional Manager. Your letter, together with any response by us, will be considered by the FDIC in evaluating our CRA performance and may be made public.You may ask to look at any comments received by the FDIC Regional Manager. You may also request from the FDIC Regional Manager an announcement of our applications covered by the CRA filed with the FDIC.

BRANCH(ES) (EAST AURORA AND ELMA)

Under the Federal Community Reinvestment Act (CRA), the Federal Deposit Insurance Corporation (FDIC) evaluates our record of helping to meet the credit needs of this community consistent with safe and sound operations. The FDIC also takes this record into account when deciding on certain applications submitted by us.

Your involvement is encouraged.

You are entitled to certain information about our operations and our performance under the CRA. You may review today the public section of our most recent CRA Performance Evaluation, prepared by the FDIC, and a list of services provided at this branch. You may also have access to the following additional information, which we will make available to you at this branch within five calendar days after you make a request to us: (1) a map showing the assessment area containing this branch, which is the area in which the FDIC evaluates our CRA performance in this community; (2) information about our branches in this assessment area; (3) a list of services we provide at those locations; (4) data on our lending performance in this assessment area; and (5) copies of all written comments received by us that specifically relate to our CRA performance in its assessment area, and any responses we have made to those comments. If we are operating under an approved strategic plan, you may also have access to a copy of the plan.

At least 30 days from the beginning of each quarter, the FDIC publishes a nationwide list of the banks that are scheduled for CRA examination by the FDIC in that quarter. This list is available from the:

Regional Manager

Division of Compliance and Consumer Affairs

Federal Deposit Insurance Corporation

350 Fifth Avenue

Suite 1200

New York, New York 10118

You may send written comments about our performance in helping to meet community credit needs to:

Donald J. Musielak

Community Reinvestment Act Officer

Bank of Holland

12 S. Main Street

Holland, New York 14080

and the FDIC Regional Manager. Your letter, together with any response by us, will be considered by the FDIC in evaluating our CRA performance and may be made public.You may ask to look at any comments received by the FDIC Regional Manager. You may also request from the FDIC Regional Manager an announcement of our applications covered by the CRA filed with the FDIC.

CRA Public Written Comments

CRA PUBLIC FILE COMMENTS

AS OF MARCH 31, 2025

The following comments have been received that specifically relate to the bank’s performance in helping to meet community credit needs for the current year or the prior two (2) calendar years:

2025: No comments received

2024: No comments received

2023: No comments received

CRA Performance Evaluation 12-31-2022 DFS

The Bank of Holland CRA Performance Evaluation published by the New York State Department of Financial Services may be obtained by clicking here.

CRA Performance Evaluation 07-05-2023 FDIC

The Bank of Holland CRA Performance Evaluation published by the Federal Deposit Insurance Corporation may be obtained by clicking here.

List of Branches/Hours/ATM(s)

AS OF MARCH 31, 2025

Bank of Holland

Main Office: 12 S. Main Street/Holland, New York 14080

Phone: (716) 537-2264 Fax: 716-655-6602

Email: admin@bankofhollandny.com

Website: www.bankofhollandny.comBranch Office(s): 250 Quaker Rd (RT 20A) East Aurora NY 14052

Phone: (716) 655-4667 Fax: 716-655-6602Elma Plaza, 2341 Bowen Rd, Elma NY 14059

Phone: (716) 537-4461 Fax: 716-655-6602

Telephone Banking: 1(866) 544-5989 Internet Banking: www.bankofhollandny.com

Mobile Web Banking: www.bankofhollandny.com

Current Banking Hours:Lobby: Monday through Thursday, 9:00 a.m. to 4:00 p.m.

Friday 9:00 a.m. to 5:00 p.m.

Saturday 9:00 a.m. to 12:00 p.m.

ELMA BRANCH ONLY NO SATURDAY HOURSDrive Up: Monday through Thursday, 8:30 a.m. to 4:00 p.m.

Friday 8:30 a.m. to 5:00 p.m.

Saturday 8:30 a.m. to 12:00 p.m.

ELMA BRANCH ONLY NO SATURDAY HOURSATM Branch Locations: 12 South Main Street/Holland, NY

250 Quaker Rd (RT 20A) East Aurora, NY

Elma Plaza, 2341 Bowen Rd, Elma, NY

(ATMs are Available 24 Hours per day, seven days a week /Deposit taking ATMs)

All ATMs are ADA compliant.Affiliate Networks: American Express, Cirrus, Discover, Quest, Jeanie, Star NE, Maestro,

MasterCard ATM, Plus, Visa ATMAdditional ATM locations: Visit our website at: www.bankofhollandny.com for

Additional ATM Locations (affiliate M&T Bank)

List of Branches Opened and Closed

AS OF MARCH 31, 2025

There have been no bank branch closings during the past prior two (2) years.

BRANCH(s) OPENED:

July 31, 2003, (with the prior approval of the NYS Banking Department and FDIC):

East Aurora Branch

250 Quaker Rd, East Aurora, NY 14052. Tract 0138.02

March 7, 2016 (with the prior approval of the NYS Banking Department and FDIC):

Elma Branch

Elma Plaza, 2341 Bowen Rd, Elma, NY 14059. Tract 0141.01

Loan to Deposit Products

AS OF MARCH 31, 2025

Credit Services Offered

The following credit services are offered by Bank of Holland:Consumer Loans

• 1-4 family residential mortgage loans

Up to 30 Year Mortgages

Home Equity Loans (various terms offered) and Home Equity Lines of Credit

• New and used mobile home loans

• New and used auto and recreational vehicle loans

• Home improvement loans

• Savings/CD Secured loans

• Other personal loans:

Direct installment loans

Single payment time loans

Demand loans

Term loans with a demand feature

• Overdraft lines of credit

• Visa Credit CardCommercial Loans

• Real estate loans

• Secured operating lines of credit

• Equipment purchase loans

• Auto dealer and mobile home floor plans

• Small Business Loans

• SBA business loan financing (PPP Loans)

• Letters of Credit

• Empire State Development Linked Deposit ProgramDeposit Services Offered

Bank of Holland offers deposit services that meet the needs of the local community.• Checking accounts

• NOW accounts

• Savings accounts

• Health Savings Accounts (HSA)

• Holiday/Christmas Club

• Money Market savings

• Certificate of deposit

• Individual Retirement Accounts (IRA)

Roth, Traditional

• Automated Teller Machine (ATM) Banking Services

• Master Money Debit Card

• Direct Deposit (ACH) Banking

• Telephone Banking (866.544.5989)

• Internet Banking (includes Bill Pay, ZELLE)

• Mobile Web Banking (APP)

• Remote Deposit Capture• Transfer Now (bank to bank)

We offer IRA, NOW and Money Market accounts, along with Senior, BankOn Smart Start Account, Advantage, Free Personal, CashBack Checking and Advantage Plus Checking, Municipal Checking, Business, Free Business, Business Relationship Money Market Savings, Health Savings Account (HSA), Statement, Passbook and Advantage Savings and Holiday/Christmas Club Savings in our deposit product mix.

Other Services Offered (available at all branches unless specified):

• Safe Deposit Boxes

• Money Orders

• Cashier Checks

• Night Depository

• Merchant Services

• Certified Checks

• Bank by Mail

• Coin Sorting Machine (EA location)

2025 Assessment Area Tracks

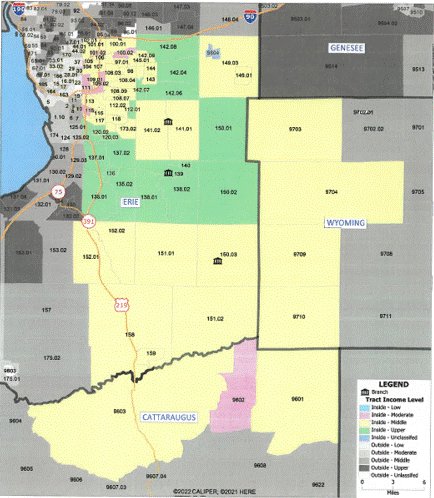

Geographically, our CRA community now consists of the Towns of Concord, Colden, Aurora (Village of East Aurora), Sardinia, Holland, Wales, Marilla, Elma, Orchard Park, Boston, Lancaster, West Seneca (all tracts), Cheektowaga (all tracts), Village of Springville and Depew in Erie County. Additionally, the Towns of Arcade, Sheldon, Bennington and Java in Wyoming County and the Village of Delevan, Town of Freedom, Alden (all tracts), Machias, Ashford, Otto and East Otto in Cattaraugus County. By definition the census tracts are:

Erie County:

0097.01 0097.02 0098.00 0099.00 0100.01 0100.02 0100.03 0101.01 0101.02 0101.03 0102.01

0102.02 0103.00 0104.00 0105.00 0106.00 0107.00 0108.03 0108.04 0108.05 0108.07 0108.08

0108.09 0109.01 0109.02 0110.00 0111.00 0112.01 0112.02 0113.00 0114.00 0115.00 0116.00

0117.00 0118.00 0120.01 0120.02 0120.03 0135.01 0135.02 0136.00 0137.01 0137.02 0138.01

0138.02 0139.00 0140.00 0141.01 0141.02 0142.04 0142.06 0142.07 0142.08 0142.09 0143.00

0144.00 0145.01 0145.02 0149.01 0149.03 0150.01 0150.02 0150.03 0151.01 0151.02 0152.01

0152.02 0158.00 0159.00 0173.01 0173.02 9804.00Cattaraugus County:

Block numbering areas 9603.00, 9602.00 and 9601.00Wyoming County:

9703.00, 9704.00, 9709.00, 9710.00

Assessment Map 2025

HMDA Disclosure Statement

HOME MORTGAGE DISCLOSURE ACT NOTICE

The HMDA data about our residential mortgage lending are available online for review. The data show geographic distribution of loans and applications; ethnicity, race, sex, age and income of applicants and borrowers; and information about loan approvals and denials.

HMDA data for many other financial institutions are also available online. For more information, visit the Consumer Financial Protection Bureau's website at www.consumerfinance.gov/hmda.

LTD Ratio

Loan to Deposit Ratios at End of Calendar Quarters

-----------------------------------------------------------------------------

03/23 73.01%

06/23 73.35%

09/23 75.07%

12/23 80.33%

------------------------------------------------------------------------------

03/24 77.33%

06/24 79.47%

09/24 80.44%

12/24 83.70%------------------------------------------------------------------------------

03/25 81.80%

06/25 81.47%

09/25 81.34%

Bank of Holland Fee Schedule

Contact us to receive our Fee Schedule

Community Outreach

Efforts to Ascertain the Community’s Credit Needs

We use our Board of Directors and our staff and management to assist in ascertaining our community’s credit needs. Our directors are all local business individuals who are active participants in the community. Our monthly Board meetings allow our directors to keep the bank informed about the business environment. Our staff and management are active in a variety of community organizations and are encouraged to bring information about the community back to the Bank. Staff and management attended community activities are reported monthly to the directors.

Efforts to Meet Community Credit Needs

We are currently open Monday through Thursday from 8:30 a.m. until 4:00 p.m., Friday from 8:30 a.m. until 5:00 p.m. and Saturday from 9:00 a.m. until 12:00 p.m. Elma branch only has no Saturday hours. We have three (3) bank site ATM machines. In addition to, and to improve customer convenience, we also have an agreement with our affiliate, M&T Bank, for our customers to use their ATMs with no surcharge. M&T ATMs are located locally and throughout the United States with over 2,000 locations. Customers can obtain the location of an ATM by logging onto our website www.bankofhollandny.com and clicking on the link provided. To further improve our customer convenience, both internet banking and mobile web banking are available at no cost. Customers can access their accounts from the comfort of their homes and facilitate banking with transfers from one account to another, review statements and use our online bill pay service. At their convenience they may also use mobile banking and make a check deposit using remote deposit capture.

The bank’s products and services were in previous years and are currently (when applicable) advertised in a variety of local daily and weekly newspapers and/or penny savers, radio, customer statements, direct mail pieces and with outdoor boards.

Bank of Holland participates in many local non-profit organizations and events. Membership includes engagement and involvement at local Kiwanis Clubs, Boys and Girls Clubs, Chamber of Commerce(s) as well as the WNY Veterans Memorial group.

Staff and management are also involved in visiting local senior citizen homes or local events to promote banking products and more importantly to offer a current and future resource on how to avoid elderly abuse and various types of fraud.

We also sponsor various charitable events throughout the year. One example is our past and current sponsorship with the Aurora Ice Association (AIA) which provides support for the Classic Rink located at 41 Riley St. in East Aurora. This facility provides the local community with many youth and adult related athletic engagement opportunities. The facility also serves as a community hub for other events ranging from various non-profit functions to cultural events. In 2018 we assisted in funding for a complete update to the facilities in the Classic Rink.

Previously we also contributed to the fund drive for the beautification project of Main St. in East Aurora and assisted with the funding for the enhancement of the East Aurora Park.

We continue to sponsor our community of Holland with its’ annual Tulip Festival which in 2018 celebrated the festival’s 50th anniversary. The event is an annual weekend gathering point for the entire town and surrounding area with the majority of the proceeds going to local non-profit organizations through a 5k Run/Walk, parade, vendor crafts, food options and midway. It is something for all ages to enjoy and takes place annually in May.

Additionally, in the past we assisted in the revitalization of downtown Holland by lending funds for the construction of handicapped access ramps along the business district on Main Street and were involved in the financing of the rehabilitation project of the Holland Girls and Boys Club.

In 2021 we assisted in the “Reaching Out Campaign” for the Rural Outreach Center (ROC) located at 730 Olean Road, EA, NY to build ROC Central. ROC helps people and families transform their lives and become whole. ROC is a place where children living in poverty are cared for as individuals. The ROC has resources to help children and families to begin to move on to a better place. A place of hope. A place where families are empowered to create change in their own lives and begin supporting hope in their children and break the cycle of generational poverty.

In 2022 & 2023, we continued to support various organizations that support families/individuals in need that include income levels of low/moderate. Organizations included FeedMore Foundation of WNY, Boys & Girls Club of Holland and other various groups.

In 2024, the bank provided $50,000 in grants to local small business customers to assist with general operating costs through the Federal Home Loan Bank’s Small Business Recovery Grant program. The bank is also a participant in the Federal Home Loan Bank’s Homebuyer Dream Program.

We continue to assess our progress in helping to meet our community’s credit needs and base our Community Reinvestment Act Action Plan by observing and reaching out to our local communities for needed project opportunities.

We assess our progress in helping to meet our community’s credit needs through an annual self-assessment. We base our Community Reinvestment Act Action Plan on this assessment.

FDIC-Insured - Backed by the full faith and credit of the U.S. Government

FDIC-Insured - Backed by the full faith and credit of the U.S. Government